Do you know your tax obligations?

The ATO has always required taxpayers to keep detailed records. In the past, the perception was that a summary of expenses would suffice and so the ATO requirement was largely ignored. The ATO is now raising awareness of this requirement through random audits, education programs for taxpayers/tax agents, applying penalties and interest charges, and so on.

We foresee that the need to keep detailed records both by taxpayers and tax agents will continue, given that most records/transactions are readily available electronically these days. At different times the ATO will target certain deductions or occupations/industries. In recent years one area of focus has been rental property deductions. Most rental property owners are keen to maximise their deductions, however, few would be happy about paying further tax should their claims be disallowed by the ATO because they can’t substantiate those claims.

We assist our clients by providing a detailed information list which can be used as a checklist to tick off records as they are collected. This helps to reduce accounting costs as there are usually fewer queries when we receive quality records in full and up front.

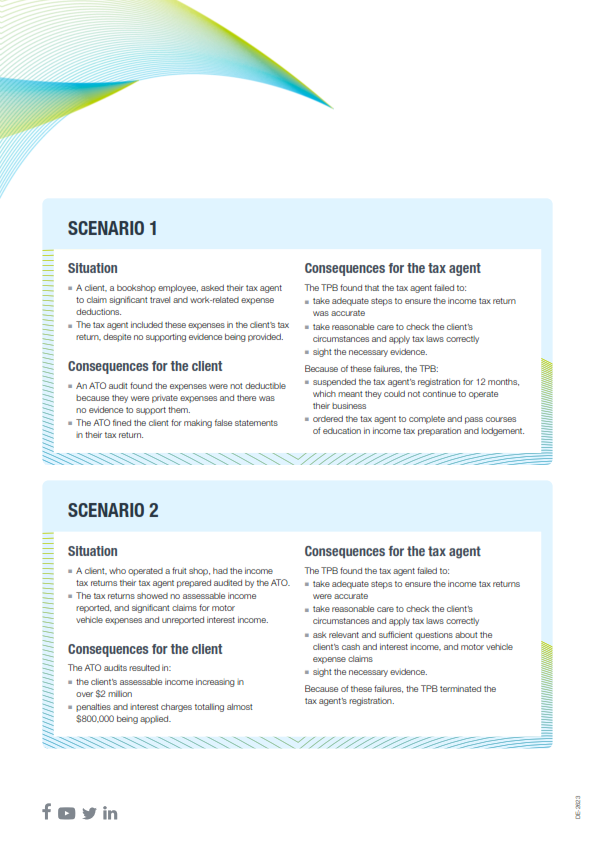

The Australian Government and the Tax Practitioners Board have released the following factsheet to explain your tax obligations and those of your tax agent.

CONTACT US TODAY so we can help you meet your tax obligations and ours!